library(Quandl)

yc_all <- Quandl("USTREASURY/YIELD")Em um post recente.

library(rb3)

library(bizdays)

library(tidyverse)

library(fixedincome)dusd <- yc_usd_mget(

first_date = "2019-01-01",

last_date = preceding(Sys.Date() - 1, "Brazil/ANBIMA"),

cache_folder = "../../../rb3-data"

)unique(dusd$refdate) |> map(function(date, df) {

df_curve <- df |>

filter(refdate == date, cur_days > 0) |>

filter(!duplicated(cur_days))

curve <- spotratecurve(

df_curve$r_360,

df_curve$cur_days,

"simple", "actual/360", "actual",

refdate = date

)

interpolation(curve) <- interp_flatforward()

curve

}, df = dusd) -> curves_usdcurves_usd |>

map_dfr(\(x) tibble(

refdate = x@refdate,

r_USD_br_10y = as.numeric(x[[3600]])

)) -> rates_usd_10yyc_all |>

rename(refdate = "Date", r_USD_us_10y = `10 YR`) |>

mutate(r_USD_us_10y = r_USD_us_10y / 100) |>

inner_join(rates_usd_10y, by = "refdate") |>

# filter(!is.na(r_USD_br_10y)) |>

tidyr::pivot_longer(c(r_USD_br_10y, r_USD_us_10y),

names_to = "rates"

) |>

ggplot(aes(x = refdate, y = value, colour = rates)) +

geom_line() +

labs(colour = NULL) +

theme(legend.position = "bottom") +

labs(

x = NULL, y = NULL,

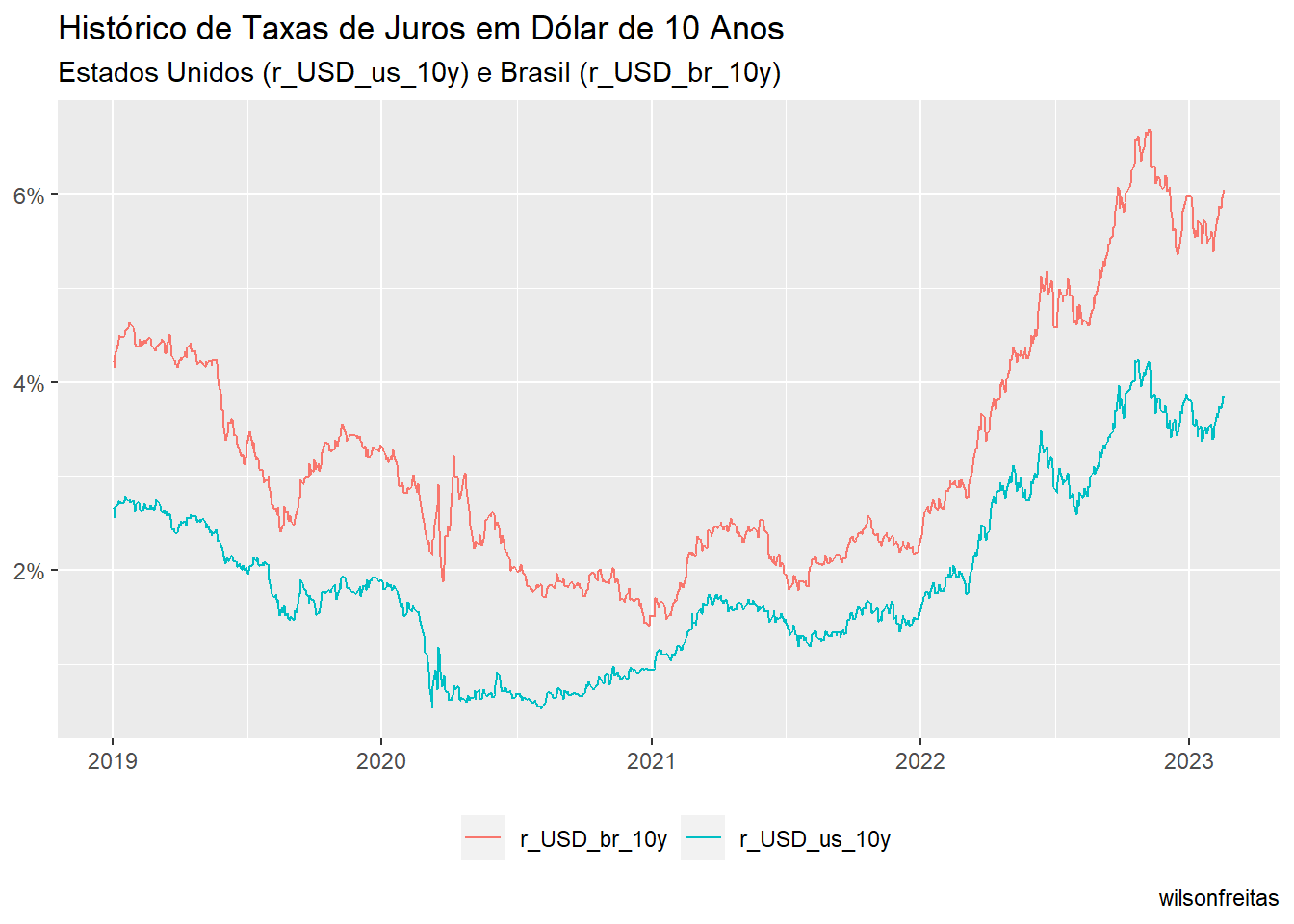

title = "Histórico de Taxas de Juros em Dólar de 10 Anos",

subtitle = "Estados Unidos (r_USD_us_10y) e Brasil (r_USD_br_10y)",

caption = "wilsonfreitas"

) +

scale_y_continuous(labels = scales::percent) +

theme(legend.position = "bottom")